Z Digital Agency does not work as a digital marketing consulting firm for any of the listed brands below.

The food delivery war is on. Deliveroo has rapidly rolled out its operation over the past 2 years in Germany and other key countries in Europe. Foodora is seriously threatened by Deliveroo (going premium and very agressive on its marketing) and Takeaway.com (Lieferando.de), an historic player.

Why are Deliveroo and Foodora spending so much money on marketing right now?

The billion dollar answer: to become the market leader, with three key benefits:

- stopping this bleeding war, i.e spending much less per order on marketing (around 1-1.5€ currently) and therefore becoming profitable.

- using that position to get better commissions from restaurant (25% to 35% currently). Booking.com has been a good example.

- stopping the fight to get riders in all cities, i.e approaching the perfect ratio of delivery/rider.

As for the geography: The UK is locked by Deliveroo, and Germany is still under the umbrella of Foodora. Germany is the second market for online food delivery in Europe, therefore we will focus mainly on this one. France & Northern Europe could also be interesting, but less critical for Foodora’s survival.

After a quick overview of the key figures and the main market dynamics of this gigantic the food delivery battle in Europe, we will focus on finding what is the ecosystem missing, trying to answer the following question: “What marketing strategy can really leverage the millions already at play, to become the food delivery market leader in Germany?”

1. The food delivery market in Europe

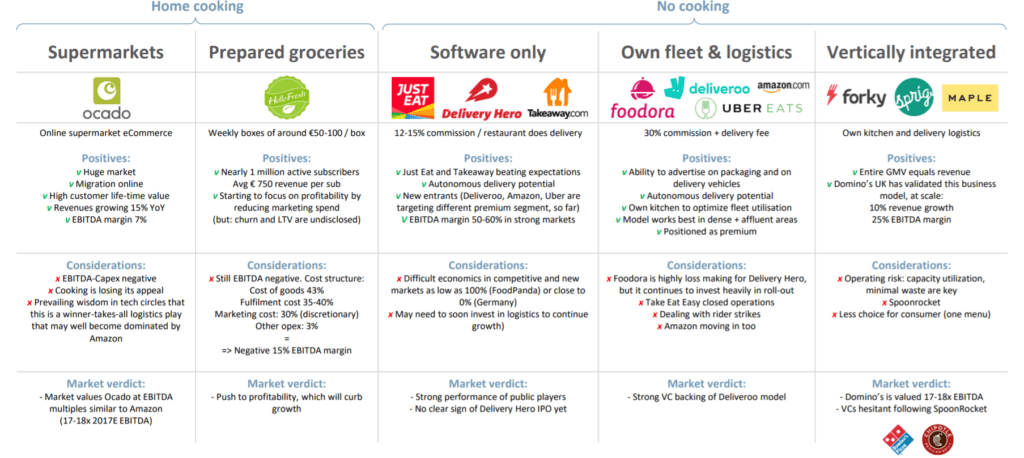

a) The competition covers all aspect of food consumption

Here is a quick overview of the main players. As you can see several models are competing:

- Supermarkets & Prepared groceries, targeting the growing Home Cooking market

- Brands targeting only the food delivery with their own fleet (like Foodora) or only as Software companies (like Delivery Hero)

- Brands integrating the entire value chain, from food preparation to home delivery (like Forky in Greece)

Excellent study coming from the Dealroom.co & A Priori Data

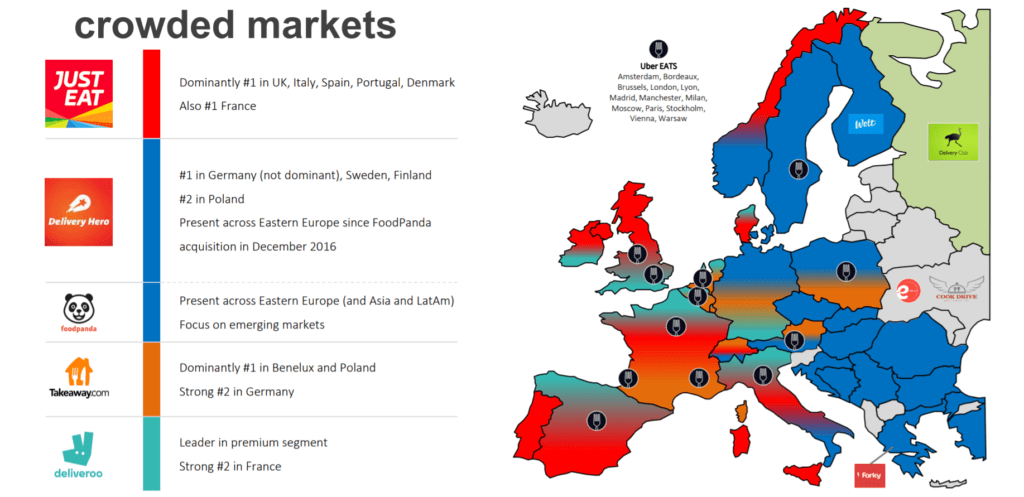

b) The competition is fierce and each country has its own battle

Even if we are going to focus on Germany, this is an interesting mapping of the competition.

However the landscape changes fast:

- With the bankruptcy of the belgian player Take It Easy in Western Europe

- With the purchase of Food Panda by Delivery Hero (integrated with Foodora) in Eastern Europe

- The amount of funding that Delivery Hero and Deliveroo manage to raise (€500M to €1.3Bn)

Excellent study coming from the Dealroom.co & A Priori Data

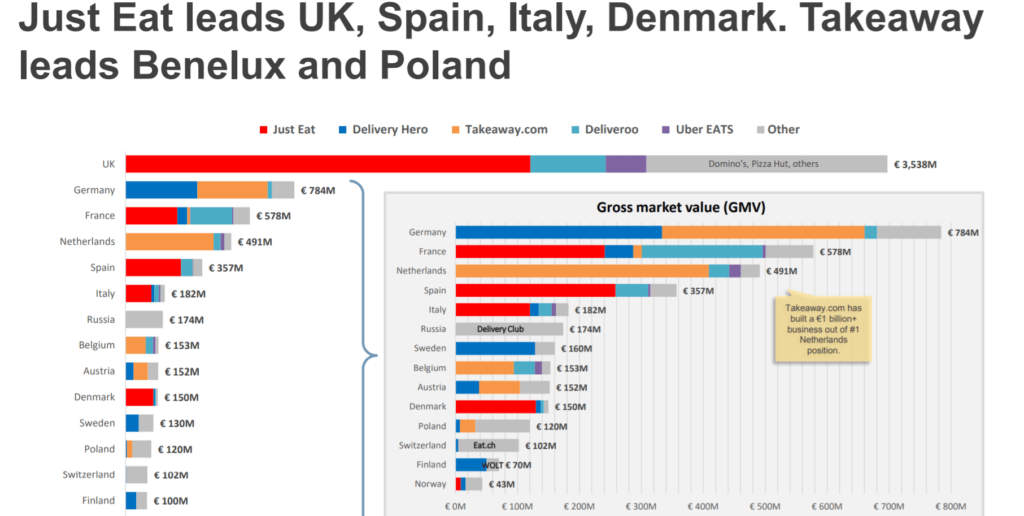

c) The markets are not equivalent in size

The UK is by far the biggest market for online food delivery in Europe. Germany is second, but the competition seems to be quite split between the main international players and the local players.

Let’s directly say that small local players will be absorded by the market leader that will get the main countries:

- either by dying slowly out of cash, without any offer from the big players (like Take It Easy)

- or by being purchased to accelerate and force a market leadership. The decision will be made by comparing the purchase price to the cost of not being the leader for a period of time: (marketing spending + commission loss) * time.

Excellent study coming from the Dealroom.co & A Priori Data

Now let’s focus on the caracteristics of the food delivery market in Germany.

2. The food delivery market economics

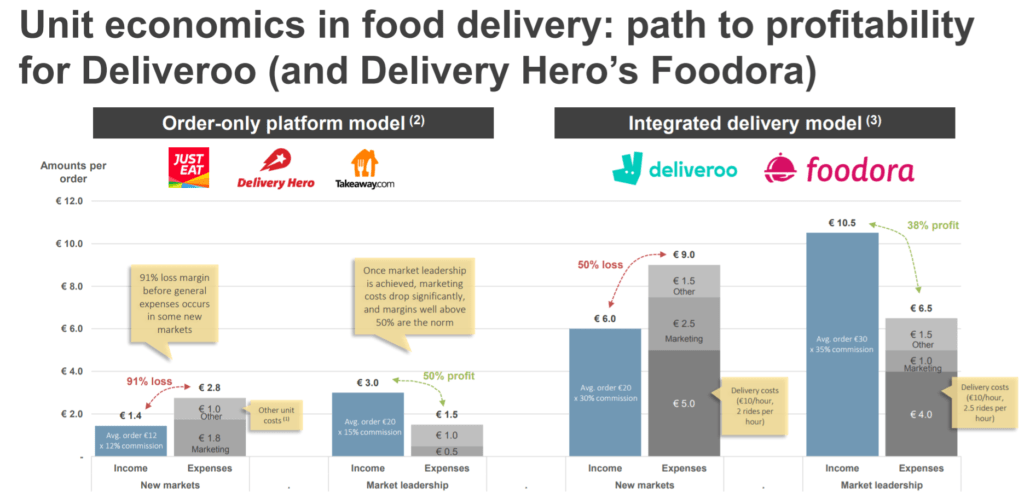

This war costs money. Even if the metrics below are already old, they give a very good insight of the cost structure, providing an insight about the key metrics-based objectives to wine the food delivery game in a country.

Excellent study coming from the Dealroom.co & A Priori Data

a) The size of the food delivery basket is #1

Even if those figures may be outdated, we clearly see the impact of a larger order basket on the profitability of the model.

In some countries Deliveroo makes you pay an additional 4€ for any order below 25€, and Foodora prevents you from ordering below that basket. In Germany however none of those tricks exist. When we see the impact of the basket size, we’d better start here.

b) The marketing budget is a large fraction of the cost structure

1€ per order means a 10% to 15% cut of your turnover, and almost 50% of your gross margin.

Therefore the key metrics of this food delivery battle will be the mid-term impact on market shares per euro spend (let’s call it MTIR = Mid-Term Impact Ratio).

The MTIR is very hard to compute, all Chief Marketing Officers know about it. But a simple version is:

MTIR = (market share at T – market share at T+1) / total marketing budget spend over the period

c) The operational costs are massive, but there is only small room for improvements

With around 4€ per delivery, we see the impact of the delivery costs. However I don’t believe in the fight for lower rider wages over the mid-term. In Germany Foodora has already integrated the riders as employees, covering their health insurance, while Deliveroo has not done it yet. I guess the cultural differences between a British and a German management are at play here. However UBER history has shown that you’d better aim for the conditions for your employees sooner than later.

Nonetheless, by paying a bit better the riders, Foodora is loosing a part of its marketing budget, and therefore market shares potential gain.

This is true if we only consider the very short term:

- New riders are necessary to get new market shares, and there is a shortage. Deliveroo is loosing one part of the triangle equation.

- Employed riders resources could become also more productive thanks to a lower turnover, boosting the delivery/rider ratio.

- Heavy technology investment and big data models could change the game, by pre-positioning and optimizing the number of riders each day with machine learning coupled to weather forecasts.

3. German food delivery market positioning and trends

We have have previously seen the importance of the basket size. Therefore going premium would immediately seems like a good answer. However the situation is a bit more complex:

- It’s a winner gets them all game: so the winner should cover a large range of the food delivery market

- Your food taste are also changing depending on the day and the time you’ll decide to spend on it. I personally consume junk food once a week and the rest of the time, more premium, depending on my work schedule and social context.

- Getting premium customers is always more expensive, but all studies (and my experience in wine e-commerce) have shown that premium customers are more loyal and less costly to handle for the customer service. Remember the rule: the less they pay, the more demands they have.

a) Positioning a food delivery brand as Premium

To fully understand the fleet-based food delivery market you have to consider this equation.

- Clients: Those who already order online, and those who don’t yet.

- Restaurants: A large range of players and a sincere fear of being stuck with one big player, like what happened with booking.com

- Riders: Mainly students and freelancers, who need a bit of money on the side, but are also your brand ambassadors

To achieve a premium branding, not only your advertising should reflect it, but your DNA should also embedd it:

- Only premium restaurants should be featured, but other buyer persona (i.e restaurant ranges) should be clear one-click away

- A smaller choice with pre-defined filters should be available. All luxury brands have a limited line of products.

- The social contexts labelled as premium should be part of the storytelling (among friends, tasty dinners, fancy appartements…)

- The purchase experience should be as smooth and fast as possible, with a one-click order for recurring customers

- A sense of community and exclusivity should be perceived by all three stakeholders

- The customer service should be willing to go the extra mile to satisfy a client

- A WoW effect should be part of the experience, surprises and small attentions go a long way, but we will discuss it further below

If we consider only the web/application experience, Foodora is definitely more premium than deliveroo. The UX is much clearer and the order process smoother. But it’s only a must-have, not a performance factor to be considered as a premium brand by all three stakeholders.

b) New comers in the game

With the launch of Amazon food delivery and UBER Eats, the competition in the world of well funded food delivery companies is getting fierce. Those two new players represent both side of the customer range, from cheap to premium. They also benefit from a very large user base and database to launch any new service, and provide a one-click purchase experience, since your payment details are already stored.

Here comes a key marketing strategy play: the ability to test and iterate very fast on a local basis.

Indeed food consumption habits are not the same in each countries. That is where UBER Eats may fail, but food delivery niche players, well established locally, could have they chance. This requires a marketing innovation process fully integrated and very bold. Rocket Internet has become an expert at this data driven fast testing process and they own Delivery Hero, the mothership of Foodora.

4. How to gain market shares ?

The most important fact about the online food delivery market in Germany (and other european countries) is the low level of penetration in comparison with the UK.

Excellent study coming from the Dealroom.co & A Priori Data

On the graphics above we can guess the potential for growth: Germany is the biggest food market in Europe with €56 Bn, but only 15.2% of the food is ordered online, compared with 49% in the UK. The brand that will drive this gowth of the penetration rate will become the market leader. The question is not when, as it will eventually happen, but how.

To drive up its market share Foodora or Deliveroo will have to drive up the market share of online food ordering. We have already seen that new comers in this saturated market were actually opening new market segments (the premium segment for instance), already increase this penetration rate.

By developing buyer persona per segment, based on the large sets of data gathered over the years, these companies could deliver time-sensitive offers:

- Junk food persona: fast and cheap delivery service. One click-away

- Medium revenue couple: time-sensitive offer, just before the end of their work

- High revenue couple: quality sensitve and discovery offers

- Group of friends: practical offers, who could be shared or splitted

- Corporate workaholic: one click away and smaller choice

Each persona should be individually A/B tested of course, but push data based notifications, emails and programmatic advertising could be key.

Each persona is a new way to increase the penetration rate. Awareness has already been raised among the population, and each player is educating the market for the others. The challenge can be summarized in 2 goals:

- How to trigger the conversion at the right moment for each persona?

- How to be the first brand in mind when this need pop up ?

For the moment all marketing strategies are relying on mass communication and brand awareness campaigns. Could we go further?

- With programmatic advertising based on weather data and lookalike audiences

- With a storytelling adapted to each persona

- With a time-sensitive notification based on GPS data: “your meal in 20mn only if you order at this restaurant”

Those are only small elements part of a larger solution. Why such a difference between the UK and Germany in terms of online food delivery penetration?

5. Putting back humans at the center of the equation

a) The culture of cooking and meal sharing is much higher in southern european countries than in the northern ones. By bringing friends and family at the center of their marketing, those brands could copy the adoption rate of the frozen food industry after the second world war.

- Food delivery = diversity + quality

- Food delivery = practicality + freeing some time

- Food delivery = sharing a moment with your loved ones

So far most brands have been focused on the quality of the food, with very large close up pictures in their advertising. But food reality is the people. This includes the restaurants and the riders, all part of the story.

New persona focus on user stories of groups of friends and families are required.

b) The web adoption rates have always shown that the word of mouth was the most powerful driver. By targeting groups of people and surprising them (restaurants and riders being part of the equation), the penetration rate will increase dramatically.

c) By targeting groups in their social context, the basket size will naturally increase, a critical metrics for profitability. The development of payment systems have allowed a smooth bill splitting system to be set up:

“I order, they pay me back their share by clicking on a simple Whatsapp link”.

Such an integration with Twint, Paymitt, or any other system could be key.

d) As in any social interaction, the more people, the more ideas. One time-sensitive offer to a user can trigger a whole order from the group, turning simple users into champions.

Loyalty programs are outdated, but gamification is not, especially when the winning stakes are high (but occuring less often, like in a raffle). Champion should be rewarded a very high price, because their cost is much cheaper than the acquisition of new users.

6. The WOW Effect

As any venture-backed company, Foodora and Deliveroo investors will ask them to focus on their core business and become master at it.

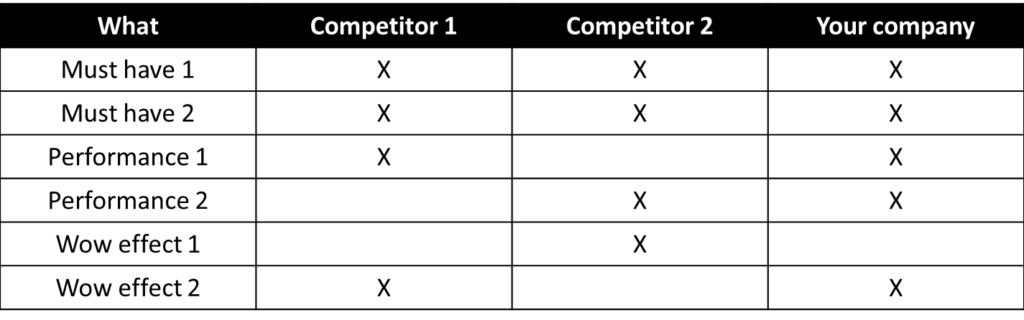

Therefore Z Digital Agency brainstormed about a potential Product Management framework.

The wrong Problem Space: How do I get my food delivered?

The right Problem Space: How do I eat ?

This way allows product managers to better play around with potential solutions later on. We will not develop here the entire lean startup methodology, but a lot of ideas emerged during the brainstorming.

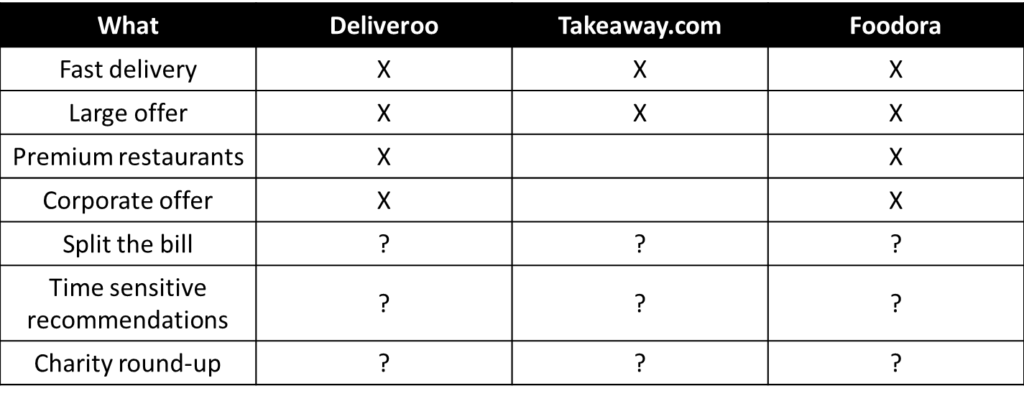

For the German food delivery market here is a possible product management matrix to really increase the word of mouth and leverage a higher MTIR.

- Putting back the human at the center with group bill splitting system

- Time sensitive offer, data driven, to target millenials at the moment they leave their office

- Create a more human approach by empowering riders and using a round-up payment system to directly fund specific charities in Germany. Like what does Smood2you in Switzerland with Cherry Checkout.

This list is of course not exhaustive, but beyond the features, a marketing methodology and a strategic positioning were developed in this study.